The recent announcements by the Office of the United States Trade Representative, USTR, and China’s Ministry of Transport signal a deepening policy standoff in maritime trade..

These actions, centred on the imposition of reciprocal port fees and tariffs, are reshaping the operational and financial dynamics of global shipping..

While the USTR has amended certain aspects of its Section 301 “Ships Action”, China has introduced a retaliatory Special Port Service Fee targeting vessels owned, controlled, or registered in the United States..

China called the U.S. actions “discriminatory” and said they “seriously damage the legitimate rights and interests of Chinese shipping companies and disrupt the stability of the global supply chain.”

Together, these measures represent a new phase in maritime economic confrontation between two of the world’s largest trading nations..

The USTR’s Section 301 modifications

In April 2025, the USTR initiated a Section 301 action aimed at promoting domestic shipbuilding and addressing perceived competitive disadvantages faced by U.S. yards.. On 10 October 2025, several amendments to this action were announced, following industry consultations and public feedback..

- Fixed service fee implementation: A service fee of US $46 per net ton will now apply to foreign-built vehicle carrier vessels calling at U.S. ports.. This adjustment replaces the variable fee mechanism, introducing greater predictability for operators..

- Removal of LNG export license suspension: The earlier clause allowing suspension of liquefied natural gas, LNG, export licenses based on vessel origin has been revoked, retroactively effective from 17 April 2025.. This provides regulatory relief for LNG exporters reliant on foreign-built tonnage..

- 100 % Tariffs on certain port equipment: The USTR will impose a 100 % import tariff on specific ship-to-shore cranes and cargo-handling equipment.. The objective is to reduce U.S. dependence on foreign-manufactured port assets, particularly those from strategic competitors..

- Proposed future adjustments: Open for public comment until 12 November 2025, the USTR is considering additional measures, including:

- Exemptions for ethane and LPG carriers under long-term charters, and

- The potential expansion of tariffs up to 150 % on a broader range of cargo-handling machinery and components..

- A deferment of service-fee payments until 10 December 2025 has also been introduced to ease short-term compliance pressures..

China’s retaliation: The Special Port Service Fee

In a direct response to Washington’s actions, China’s Ministry of Transport announced on 10 October 2025 that it would impose a Special Port Service Fee on U.S.-linked vessels, effective 14 October 2025, a move widely seen as a tit-for-tat retaliation..

Key provisions

- Fee Range: The new charges begin at ¥400 per net metric ton (about US $56) and will increase in stages to ¥640 in 2026, ¥880 in 2027, and ¥ 1,120 (around US $157) by 17 April 2028..

- Scope of Application: The fee applies to vessels that are:

- owned by U.S. enterprises or individuals;

- operated by U.S. entities;

- controlled by companies in which U.S. persons hold 25 % or more of equity, voting rights, or board representation;

- flying the U.S. flag; or

- built by U.S. interests..

- Frequency and Limitations: The fee will be charged only at the first Chinese port of call per voyage, and no more than five times per vessel per year..

The emerging two-way cost pressure

The simultaneous implementation of the USTR and Chinese measures creates a dual-sided financial and operational burden for global shipping lines..

- U.S.-imposed costs: Increased port fees and tariffs on foreign-built vessels and equipment will raise costs for international operators calling at U.S. ports or sourcing critical port infrastructure..

- Chinese Counter-Measures: U.S.-linked owners now face new charges when calling Chinese ports, including those operated under complex international joint-venture or financing structures..

The result is a form of bilateral maritime cost escalation, where the economic impact is not limited to direct U.S. or Chinese operators but extends to globally diversified fleets, multinational charterers, and energy carriers..

Strategic considerations for the industry

Shipowners must now reassess their equity and flag structures to identify whether their fleets fall within China’s 25 % ownership or control threshold or whether any of their vessels linked to U.S. interests could face unexpected exposure under the new rules..

Operators may also need to rethink voyage patterns.. Since the Chinese fee applies only at the first port per voyage, route adjustments or consolidated port calls could help limit recurring costs..

Contracts will need revisiting too.. Charter parties and service agreements should clearly assign responsibility for new regulatory-driven expenses to avoid future disputes..

At the same time, industry stakeholders should use the USTR’s open comment period to present data and suggest practical adjustments before the rules become entrenched..

Finally, carriers should watch for similar measures elsewhere.. This U.S.–China precedent could inspire other governments to impose their own reciprocal port fees, adding yet another layer of compliance complexity across global shipping lanes..

Conclusion

The maritime sector is once again at the intersection of trade policy and geopolitics.. The latest U.S. and Chinese actions illustrate how strategic industrial objectives are being advanced through port access and fee mechanisms rather than traditional tariffs alone..

While the direct intent may be protection of domestic shipbuilding and port-equipment industries, the broader outcome is heightened cost volatility, increased administrative complexity, and potential route realignment within global shipping networks..

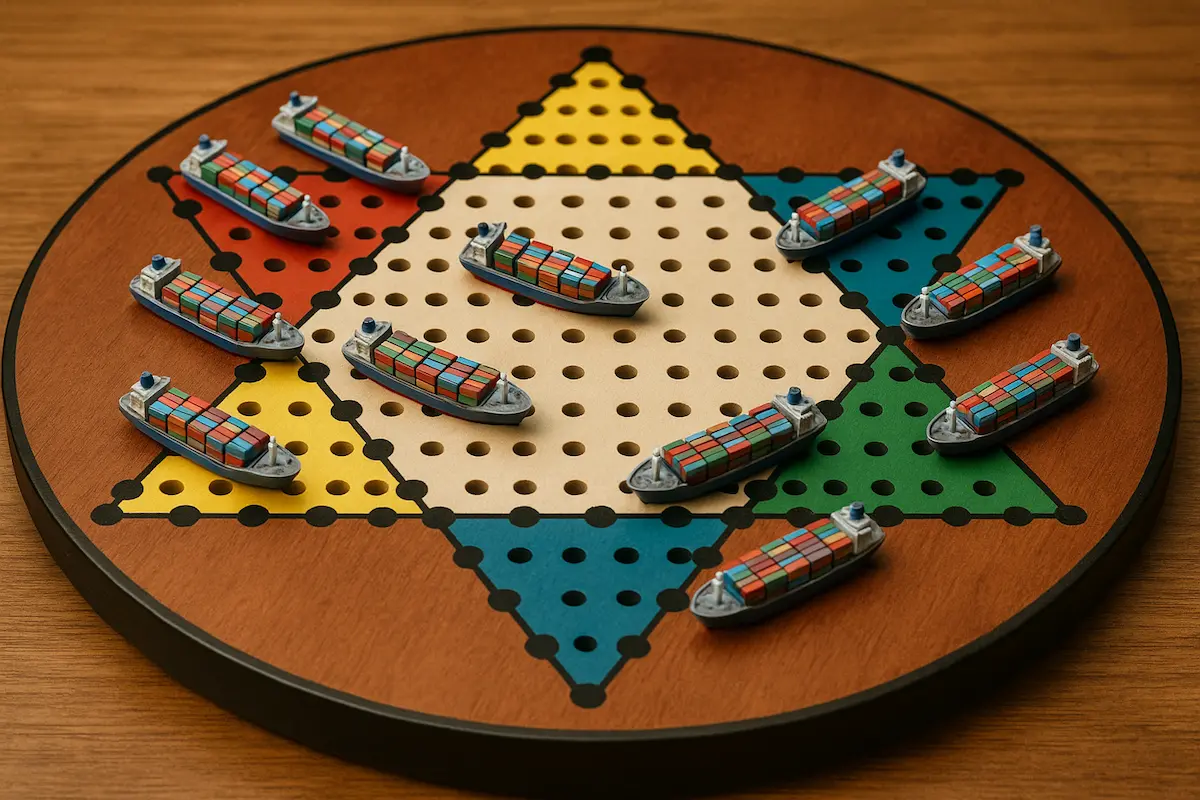

As each side mirrors the other’s play, China’s swift countermeasure raises the question: Has the USA been Chinese Checked in the port fee game..??