What happens when a nation decides it’s had enough of being on the receiving end of one-sided trade deals..??

On April 1st, 2025, the United States effectively answered that question when President Donald J. Trump declared a national emergency under the International Emergency Economic Powers Act (IEEPA), launching a sweeping new tariff regime to rebalance America’s trade relationships..

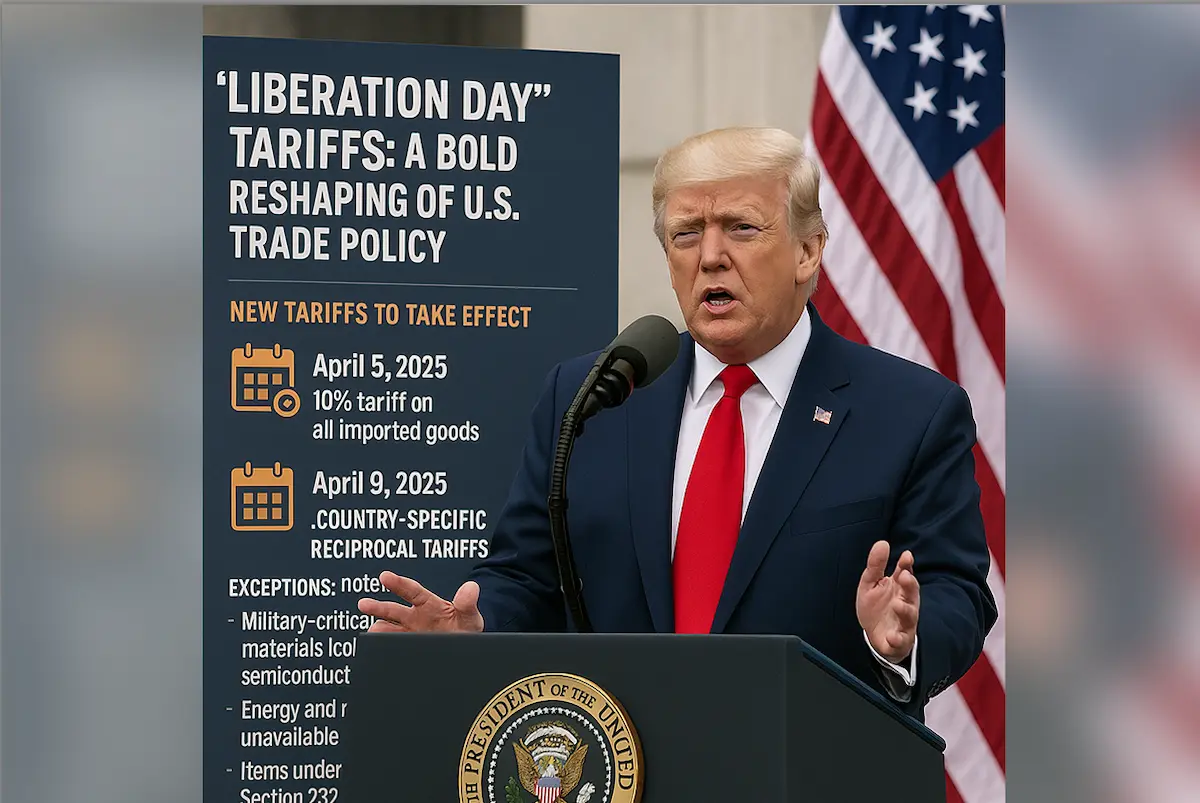

This move, coined by the administration as “Liberation Day,” marks a significant shift in how the United States intends to reclaim its economic sovereignty, protect its manufacturing base, and restore fairness in global trade..

Let’s unpack what this means and why it matters to stakeholders across supply chains, global logistics, and trade policy..

A new tariff era begins: What’s changing from April 2025

The crux of the emergency declaration is the imposition of new tariffs on all U.S. trading partners. This will roll out in two phases:

- A universal 10% tariff will apply to all imported goods starting April 5, 2025..

- Country-specific reciprocal tariffs, targeting nations with whom the U.S. has the largest trade deficits, will be introduced on April 9, 2025..

- These may exceed the base 10% rate..

According to the fact sheet, the administration will reserve the right to modify these tariffs—either increasing them if countries retaliate or lowering them if those countries demonstrate a willingness to reform non-reciprocal trade practices..

Some exemptions include strategic or sensitive goods such as:

- Military-critical materials (e.g., copper, semiconductors, pharmaceuticals)

- Energy and minerals not available domestically

- Items already covered under Section 232 tariffs (steel, aluminium, autos)

For Canada and Mexico, existing IEEPA orders tied to fentanyl and migration issues remain in effect.. This means that USMCA-compliant goods remain tariff-free, while non-compliant goods face a 25% tariff..

Why now: The rationale behind the tariffs

President Trump’s team argues that these tariffs are long overdue, citing a range of economic imbalances and security vulnerabilities:

- A $1.2 trillion U.S. goods trade deficit in 2024..

- The offshoring of over 5 million manufacturing jobs since 1997..

- Increasing dependency on adversaries for critical supply chains..

- An economic system where foreign governments impose high tariffs and VATs on U.S. exports, while the U.S. keeps its trade doors open..

In essence, the administration views the current global trade framework as one that punishes those who play fair and rewards protectionist economies..

The fact sheet takes sharp aim at countries like India (70% auto tariffs) and Turkey (60% on apples), while pointing out that U.S. automakers face non-tariff barriers in Japan and Korea that stifle access..

Manufacturing revival and national security

The announcement places heavy emphasis on rebuilding domestic manufacturing—not just for economic growth, but as a matter of national defense.. The U.S. is reportedly facing:

• Low stockpiles of military goods

• Vulnerability in strategic sectors such as shipbuilding, microelectronics, and battery production

• A shrinking share of global manufacturing output, down from 28.4% in 2001 to 17.4% in 2023

The new tariffs are seen as a way to incentivise the re-shoring of production and to restore the industrial capacity needed to sustain America’s strategic independence..

Trade policy as a political cornerstone

The fact sheet leaves little doubt that this bold move is both a policy tool and a political statement.. “Reciprocal tariffs are a big part of why Americans voted for President Trump,” the document asserts, positioning the announcement as a fulfillment of campaign promises..

It also underscores the President’s view that “access to the American market is a privilege, not a right,” advocating for the Golden Rule of trade: treat others as they treat you..

Economic impact: Tariffs and inflation—what’s the cost..??

Tariffs often raise fears about inflation, but the administration seeks to allay such concerns. It cites multiple studies, including:

A 2024 analysis projected that a 10% global tariff could grow the U.S. economy by $728 billion, create 2.8 million jobs, and raise real household incomes by 5.7%..

Research from the U.S. International Trade Commission and Economic Policy Institute, suggests minimal inflationary impact and measurable reshoring benefits..

Former Treasury Secretary Janet Yellen is even quoted stating that consumers won’t face “any meaningful increase in the prices they face.” Still, this will be something to watch as the measures unfold..

The global ripple effect: What should trade professionals expect..??

From freight forwarders and customs brokers to shippers and port authorities, these new tariffs could bring both challenges and opportunities:

- Increased import costs could pressure supply chains and force companies to source domestically or shift to compliant trade routes..

- Exporters may benefit from a re-energised local manufacturing ecosystem and enhanced trade incentives..

- Non-U.S. producers may need to restructure pricing or find ways to comply with new U.S. standards..

Logistics professionals should also keep an eye on possible retaliatory measures from major economies, and how these might impact freight volumes, port activity, and inventory strategies..

Closing thoughts: A defining moment in trade history

Whether you see it as a protectionist policy or a strategic correction, the April 2025 tariff plan is undoubtedly one of the most significant trade manoeuvres in recent U.S. history.. It calls into question decades of global trade norms and places a bold bet on reshaping the American economy from the factory floor up..

For stakeholders in global trade, this isn’t just a headline—it’s a signal to reevaluate supply chain risk, reconfigure sourcing models, and keep one eye on Washington and another on WTO reactions..

After all, when tariffs become the new normal, the smartest in trade adapt—not just to survive, but to thrive in the reshaped global order..